Basics of Labor Standards Laws 1

I sometimes hear complain raised from workers against employers for working conditions, discriminations, difference of customs. This often comes from a lack of knowledge of workers or countermeasures of employers for Japanese laws. Because of that, I’d recommend to learn basic Japanese laws especially labor and tax-related laws.

Japanese labor and social insurance laws and regulations apply regardless of nationality. For example, discrimination of low wages, long working hours, and others due to being a foreigner is not allowed.

Employers are obliged to take practical operation based on the following guidelines.

- Ensuring proper working conditions for foreign workers

- Ensuring safety and health

- Application of employment insurance, workers' accident compensation insurance, health insurance, welfare annuity insurance

- Appropriate personnel management, education and training, benefits

- Prevention of dismissal and assistance for reemployment

If there is a problem or misunderstanding, you can contact with a local government counselling service or non-profit organization, embassy of your country, or a private immigration consultant. Before the problem occurs, I would suggest to be prepared with basic knowledge of Japanese labor related laws such as;

- Labor Contracts

- Wages

- Working Hours

- Holidays/Vacations

- Annual Leaves

- Taxes and Social Insurances

1. Labor Contracts

Japanese labor laws apply to foreign workers as well as all employees in Japan. Employers must not engage in discrimination to people with any nationality.

Labor ontracts and working conditions shall clearly be stated in a written document and kept by an each party. If the contract is written in Japanese, it may be possible to have it translated into your own language. A labor contract must meet the standards of the law. Thus any future troubles can be avoidable. The contract mainly includes;

- Period of the labor contract

- Term employment; renewal or fixed, etc.

- Working place and job duties

- Basic salary and overtime allowances

- Working hours, breaks, days off, paid leave

- Dismissal

2. Wages

“Wage” is the generic term that includes the wage, salary, allowance, bonus and every other payment in the Labor Standards, Law. The employers are required to provide the employees with written details of wages and handed directly to the employees. The wages must be paid in full except for deductions of taxes, social and health insurance premiums, and others and be paid on a definite date according to the written agreement.

3. Working Hours

The Labor Standards, Law imposes an employer shall keep the rule of work up to 8 hours per day, 40 hours per week. While it is allowed modified working hour systems under specified guidelines in business variations.

4. Holidays/vacations

Employer must provide employees at least one holiday per week or 4 holidays during a four-week period. In regard to break time in a work day, at least 45 minutes for over 6 hours, and 60 minutes for over 8 hours, an employer must provide to employees. The rate of premium for overtime work is 25% or more and it is 35% or more on holiday.

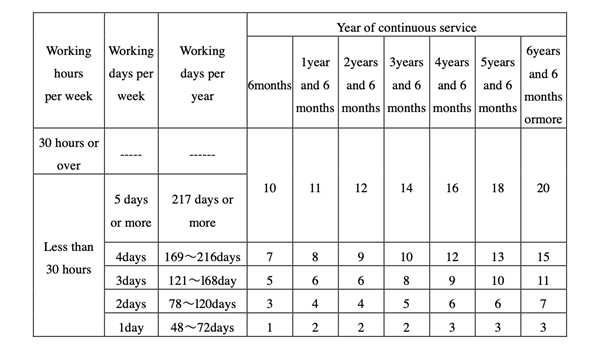

Annual paid leave of working days are allowed to take for employees who continuously work for 6 months or more, 80% of the total working days. The leaves can be taken one time or divided portions.

The following table shows paid holidays and service days.

5. Annual Leaves

Maternity Leave and Child Care Hours and leaves are stipulated by the Labor Laws. Other care leaves such as Sick/Injured child and Family care, Nursing care leaves are also allowed to an employee. Those who took the leaves cannot be dismissed or given harassment. An employer is under obligation to take the necessary measures for employees not be discriminated by taking such leaves.

6. Taxes and Social Insurances

Employees in Japan are subject to two kinds of taxation. One is income tax and the other is inhabitant (resident) tax. They are deducted from monthly salary based at a fixed tax rate.

Social Insurance premiums are also deducted from each person’s salary. There are Health Insurance, Pension Plan, Employment Insurance. In regard to Workers’ Accident Compensation Insurance premium are paid by an employer. Each of the rate changes depending on a person’s income.

Here is an example salary scheme. (as single status)

| Monthly Salary | JPY300,000 |

|---|---|

| Income Tax | JPY2,780 |

| Resident Tax* | JPY30,000 |

| Employment Insurance | JPY1,140 |

| Heal Insurance | JPY18,525 |

| Pension | JPY34,770 |

| Net income | JPY212,785 |

*Resident taxation begins following year.

The deduction is approximation depending on the government yearly, regional rates.

This is an introduction as of February 20, 2021. I will add at every opportunity in the future. Thank you for reading till the end of this article.

>> NEXT (Basics of Labor Standards Laws 2)